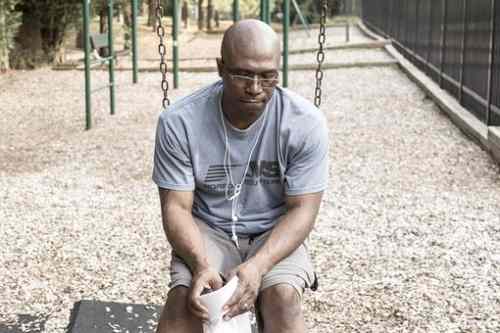

Gbenga Thomas recently got a well-deserved promotion in a leading manufacturing company. He earned a decent income with good perks and had plans to move his family to a new apartment in a nicer neighbourhood. He had managed to save N3,500,000 for 2 years’ rent and placed it in a fixed deposit for 90 days, earning 14% per annum.

One Friday evening at the club, his old friend Shayo Segun was full of excitement and convinced him to break the investment as he could help him to make three times that amount in the same period. He could then use the proceeds to invest in property and still have enough to take his family on holiday. Shayo regaled him about how much he had made himself.

Gbenga had known Shayo since they were boys and decided to break part of his investment to follow Shayos advice. He didn’t discuss it with Bimpe, his wife, as he knew she would never let him risk their rent based on what Shayo said. When the first credit came, he couldnt believe it; he felt much more confident and put some more in. Again, another credit. He was minting money. He then broke the entire investment and invested it along with the profit and the childrens school fees. That was the last he saw of his money. Gbenga had never had issues with his blood pressure. This was the beginning of health challenges.

Last week, it was reported the EFCC arrested 3 people in relation to duping people of their “investments” made in Swiss Golden. Reports say that over 3 billion naira has been invested in the scheme and the EFCC was only able to recover a little over 200 million naira.

It is very disturbing that just over a year when Nigerians lost billions of naira to the MMM scandal, thousands of Nigerians have again lost their life savings. One would have thought that people had learnt a bitter lesson.

So, why will people put their hard earned life’s savings in a phantom investment”, a Ponzi Scheme?

A Ponzi scheme is a fraudulent investing scam promising abnormally high rates of return with little risk to investors. The Ponzi scheme generates returns for older investors by acquiring new investors. Perpetuation of the high returns requires an ever-increasing flow of money from new investors to keep the scheme going.

This is similar to a pyramid scheme in that both are based on using new investors’ funds to pay the earlier backers as opposed to any from profit earned from an underlying asset. When new entrants slow down or dry up it will eventually and inevitably collapse.

[Tweet “Don’t let wishful thinking cloud your better judgment; if something sounds too good to be true, it probably is too good to be true!”]

Why do people keep falling for these scams?

To my mind, there are at least 3 reasons: greed, poverty and ignorance. Greed can be defined as an excessive desire to acquire or possess more”, especially more material wealth; greed is about excessive want. Greedy investors tend to be impatient and unrealistic. They throw caution to the wind and invest based on vague, subjective information, tips, hype, and rumor with the hope of a quick windfall rather than with informed due diligence in pursuing a carefully crafted plan. The investor often doesn’t understand the nature of the investment and assumes only the best, completely ignoring the worst.

We love easy money and often forget that it isn’t that easy to make money. In a very ostentatious materialistic society it is easier to fall prey to the scams where there is much energy spent in trying to outdo one another with all the lifestyle trappings. The Internet makes everyone and everything look so wonderfully happy, beautiful and rich!

When it comes to investing, far too many people tend to follow the crowd and invest in the latest fad; this can prove to be disastrous, as such investments usually carry an extremely high degree of risk and are unsuitable for most of us. Adverts and rhetoric will show people making huge amounts of money to entice the greedy onlooker who then jumps on the band wagon and loses his or her shirt.

Poverty drives people to desperation; and nobody enjoys the endless struggle to end poverty; the lure of instant gratification becomes attractive. With clever marketing, it is easy to be enticed by one scheme or the other to make some money particularly if you are uninformed.

Unfortunately financial knowledge is not taught in schools and we grow up with very little knowledge about how money works or how it can work for us. It is important that you develop your knowledge of financial matters through reading, seminars and so much information online. This will give you at least a better chance and understanding of the available options for your money. Without being informed, it is easy to be enticed by supernatural profit.

[ Teaching your child about money]

We all have different money personalities. How much risk are you willing to take? Are you risk-averse, somewhat conservative, moderate, or are you a fearless risk taker that would you risk the family home for a hunch? Sadly as regards the Ponzi Schemes, most of those that dive in, actually don’t even realize that they are taking risk.

Of course, every day there are people who do suddenly get rich by winning the lottery, hitting the jackpot on a gambling machine, or betting on a rare stock that skyrocketed overnight. These things can happen; its usually because they were lucky; we cannot live life based on luck as luck goes both ways; it can run out.

Having observed successful investors for many years, it is clear that there is no magic formula for investing. Successful investing requires a well-thought-out plan usually tied to short, medium and long term goals. It also comes from focus, patience, discipline and consistency; it doesn’t just happen overnight.

Successful investors aren’t looking for a miracle; they are more realistic and seek steady ways to improve their performance over time in a rational manner rather than latching onto the next get-rich-quick opportunity of which they have little information. They seek professional advice and apply their own knowledge and experience in coming to their investment decisions.

“Don’t put all your eggs in one basket” is a well-known adage. It is one we must all try to embrace in our investing lives. An important ingredient of successful investing is to build a diversified portfolio so you don’t risk everything in one investment. Successful investors do lose in some investments but make up in several others.

Unfortunately thousands of Nigerians will continue getting scammed. It is tempting to try to get rich quickly. However, the process of getting rich slowly and steadily via saving and long-term investing in a diversified portfolio is tested and more reliable.

Don’t let wishful thinking cloud your better judgment; if something sounds too good to be true, it probably is too good to be true!

For more personal finance tips, contact Nimi:

Email: info@moneymatterswithnimi

Website: www.moneymatterswithnimi.com

Twitter: @MMWITHNIMI

Instagram: @MMWITHNIMI

Facebook: MoneyMatterswithNim