Although any form of stress can take its toll on your health, stress related to financial problems can be especially toxic and is one of the worst forms of stress. The Coronavirus and the subsequent lock-down are having a devastating impact. The impact is being felt in our lives and on the livelihoods of individuals, households, businesses, communities and national economies.

Financial Troubles

Financial troubles come in so many forms; no one could ever have predicted the sheer magnitude of this global pandemic let alone the financial turmoil that it would bring. Most Nigerians are currently facing a very uncertain time with both personal and business finances in distress resulting in intense stress and anxiety.

There are some tell-tale signs that we should all look out for that must be addressed before they become chronic and put one in danger of stress-related behaviours and illnesses. These include headaches and migraines, insomnia, panic attacks, feelings of lethargy, aggression, alcohol and drug abuse, domestic violence, depression and suicidal thoughts.

Financial problems must be tackled head-on, otherwise, they fester and become critical.

Here are some of the most challenging problems families are currently facing

Rent

Rent gulps a huge amount out of already stretched incomes. Landlords depend on their rental income, so naturally must request for prompt payment. You might have lived in a house for years and have become accustomed to a certain status and standard of living in a particular neighbourhood, but you simply can’t afford to renew the rent.

Be honest with yourself; if you cannot afford to live in a particular neighbourhood, you should consider either moving to a smaller, less expensive property or move out of the area into one that you can afford.

School Fees

School fees are one of the largest expenses that parents face over several years. With the loss of jobs and incomes, the next few semesters are likely to be challenging for those without an educational plan in place. Even where there may be a slight drop in fees as schools move online for the foreseeable future, many parents must invest in equipment and devices to make it possible for their children to continue to learn efficiently and effectively from home.

What is more important is to find a school that has decent standards and faculty, and even if it doesn’t have all the frills, one that you can afford. Most important is the investment you make in parenting at home.

For many families, there is simply no money to fund their children’s education. Without benefactors, older children may either have to defer the completion of their studies for a season, whilst they earn and contribute to their own education, or can take advantage of part-time or evening classes.

One positive fallout of this global pandemic is that it has opened up a whole new vista of opportunity in the education space with exceptional possibilities for online learning. It is worth exploring these as an alternative solution at a reduced cost. Read how to prepare your child for online learning.

Impact on your Family

Of course, there will be a psychological impact from any sudden change for you and your family, but cutting back drastically on such major expenses such as school and housing will reduce the pressure and certainly alleviate the seemingly insurmountable burden of huge bills.

So many have borrowed for business and personal reasons. Debt will not go away until you tackle it head-on and give it the necessary attention it deserves. Start with the most urgent or the most expensive debt. Where your debt is becoming overwhelming, approach your lenders and be honest about your difficulties; you may be able to negotiate a more palatable repayment plan. Some friends or relatives might even write off part or all of the debt because of your transparency.

Health Insurance

Health insurance matters more than ever now. Embedded in some life policies are unemployment benefits that will help cushion the effect of unemployment for a time. Your insurance premium is one financial expense that mustn’t lapse. You have assets of value that will be difficult to replace; your car, your home, your possessions. Insurance will give much relief should anything happen.

If you get sick, not from Covid-19, but from any another illness, do you have medical insurance in place or do you have to pay up in cash at a time when your income is already strained? Medical attention must be available if you need it so that festering problems do not become real emergencies. Don’t wait for an unfortunate incident before you recognize the need for insurance. The insurance premium is a small price to pay to protect yourself and your loved ones and gain much-needed peace of mind.

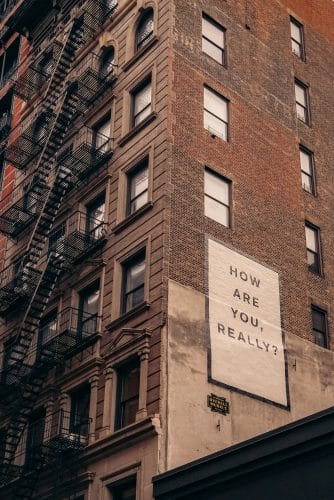

It is so important to seek help if you are feeling overwhelmed and have difficulty coping mentally and emotionally. The last thing you should be doing now is to withdraw and keep the feelings of despair in. This is the time to call a close friend or member of your family that you can trust and confide in. Many churches or mosques have a welfare team who provide online counselling for members during such challenging times. Professional counselling services are also available. Read How to Manage stress, anxiety and fear at this time.

You cannot wish away the enormous problems; serious financial challenges require concrete action. This includes cutting back on non-essential expenses, changing your spending habits, seeking ways to increase income including leveraging on and monetizing your talents and skills, selling some assets you don’t need or borrowing as a last resort.

[Tweet “If you have been caught out without an emergency fund this time, make this the first thing you put in place when things improve”]. Start to build a cushion of about six months of your basic expenses. By setting aside a buffer, should you face a financial emergency, you will be better able to ride the storm.

Are you smart enough financially?

It is so important not to be embarrassed by your financial situation. This difficult time will pass, and you cannot afford to break down totally. This will only make the situation worse and put you and your family into a far more difficult predicament.

Ultimately it is through financial discipline that you can overcome financial challenges and times of economic uncertainty. This requires the development of a long-term financial plan, focus, and commitment to change for it to last. Financial health and mental health are so closely intertwined. With sound financial health, peace of mind is more likely. At least, there is one less thing to worry about.

The theme for Mental health Awareness Week which runs from 18th – 24th May 2020, is “kindness”; it gives focus to the power and potential of kindness. Protecting our mental health is going to be an important aspect of national healing and recovery from the coronavirus pandemic; psychological and social scars tend to outlast the physical manifestations.

One positive outcome of this ordeal is that the Coronavirus is unlocking our shared humanity. Kindness is at the centre of our health; both physical and mental, and it heals both the giver and the recipient. Be kind to everyone that has the privilege of crossing your path, and most of all, don’t forget to be kind to yourself.

Nimi Akinkugbe has extensive experience in private wealth management.

Website: www.moneymatterswithnimi.com

Twitter: @MMWITHNIMI

Instagram: @MMWITHNIMI

Facebook: MoneyMatterswithNimi