What a wonderful weekend I’ve had watching every last detail of The Royal Wedding. The dress, the music, the pipe organ, the choir and orchestra, the flowers, the pomp and pageantry!

If you grew up on Grimm’s Fairy Tales, you were conditioned to dream of a fairy tale wedding perhaps to a real prince. Parents are often under a lot of pressure to give their children the ‘perfect’ wedding; this can be extremely expensive. To avoid getting overwhelmed by all the expenses, look carefully at the cost implications and prioritize right from the start.

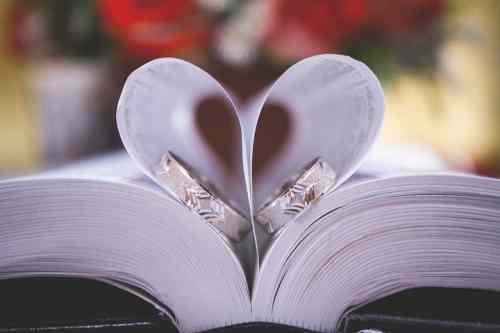

Many couples get carried away with the idea of the wedding and do not stop to contemplate the actual marriage. Sit down with your fiancé and talk about your goals and what you would like to achieve in the next year, five years and beyond, such as starting a family, buying a new car or paying a deposit on your first home. Write these goals down and keep them in view as you discuss the wedding plans. This should help you keep things in check as you prepare for life’s journey together.

[Transitioning from a Lagos Bride to a LagosMum]

Prepare a budget

A good first step to keeping costs under control is to prepare a budget. Make a list of everything you can think of; include pre-wedding events, the traditional and religious wedding ceremonies, the wedding reception and the honeymoon. What matters most? Build in a contingency fund for unplanned expenses because there will always be some.

Costs will usually include invitations, the wedding dress, hair and make up, outfits for bridesmaids and groomsmen, church fees for choir and musicians, DJ, band, reception venue, caterer, wedding cake, photographs, videographer, florist, guest favours, hotel, transportation, pre-wedding entertainment, honeymoon etc. An event planner takes so much off you and they are usually able to negotiate with a network of vendors for significant discounts, extras or to waive certain fees.

In Africa, a marriage is much more than a union between two people; it is a marriage of two extensive, extended families. One of the biggest cost factors is likely to be the number of guests that will attend, often without formal invitation. If your average cost per person for food, drink, and rentals is N10,000, removing thirty people from your guest list will save you N300,000.

A buffet menu tends to be cheaper than a plated one. Guests have come to expect and enjoy a good selection of mouth watering “small chops” that are filling and are reasonably priced at between N600 – N2,000 per head depending on the menu.

Drinks are a major cost particularly if spirits, fine wines and champagne are on the list. Even where you bring your own drinks, corkage rates can be prohibitive. A way to limit bar costs is to provide guests with basic drinks including; water, fruit juices and soft drinks and drink tickets specifically for alcoholic drinks; after using their tickets, guests can purchase additional drinks with cash should they wish to do so. This is fairly common in other societies, but may be sniffed at here!

Guest favours need not be expensive; a small meaningful memento of sentimental value will do. Large wedding cakes are a huge waste as desert is usually served at the wedding. A wedding planner mentioned that about 50% of the wedding cake goes to waste as half the guests have left before it has even been cut and shared! Apparently, you can still achieve the glorious look of the multi-tiered wedding cake billed to impress, if you replace some of the tiers with “dummy” cakes!

What is most important to you? The ring, which you will wear, hopefully for decades, your wedding dress, or the photographs and video that capture the memories? You can buy an inexpensive yet beautiful ring, and then upgrade as a sentimental gesture on a future anniversary and as you refine preferences. Bridegrooms and groomsmen routinely rent their outfits, but most brides will gasp at the thought of renting the dress of your dreams at a fraction of the cost of a new dress!

Start early and plan ahead

In an ideal world, parents should have been setting aside funds for family weddings as with other major goals such as funding your child’s education. Once you have passed the education funding hurdle, this is likely to be the next big spend.

Invest according to your time horizon.

For a wedding that’s just less than a year away, funds should be placed in a bank, fixed deposit or a money market mutual fund. If the expected marriage is still over five years away, you might invest in a portfolio of blue chip stocks or property for the prospect of long-term capital growth. An equity fund offers flexibility, diversification and professional management. Remember that investing comes with risk so be sure to seek professional advice.

Who pays for what?

In the past, the bride’s family was expected to cover most of the costs. Nowadays both families tend to play a role and the division of costs is largely dependent on each family’s financial standing and of the bride and groom themselves. It is less about protocol, but rather, about circumstances and common sense, that should dictate who pays for what. Also, determine what the budget is and try to stick to it.

Attempting to split the bill between two families can be complicated so there must be absolute clarity about how much each is willing and able to support. The couple and their families should meet for a frank discussion as early as possible. Don’t feel bad if you are the brides’ parents and can’t afford to pay for the entire wedding. Don’t be railroaded into wiping out your retirement savings just to keep up appearances.

Sometimes the family that is contributing more might feel entitled to more control and make the others feel like the poorer relations. Avoid strained relationships ahead of the wedding. Be sensitive, as money

conversations can be awkward.

[Love and money : handling awkward conversations]

For late in life marriages, as the couple might have been working for many years, they should be able to finance their wedding themselves. As often this can come with “baggage,” discussions should include,

health insurance and even prenuptial agreements.

Here are some don’t dos.

Don’t jeopardize your retirement plans

It is nice to always want to put your children first, but you can’t afford to sacrifice your retirement to fund your children’s weddings.

Avoid borrowing to finance a wedding

It is never wise to begin a marriage carrying significant debt. Try to avoid going into debt unless there is an expected inflow.

Downsize

You don’t have to invite everyone you know; Invite only those people who are most important to you. You will upset some people.

Yewande Zacchaeus, CEO of Eventful Ltd, a leading Nigerian event planning company says, “Most of the weddings we organize range from 1,000 to 2,000 guests. Our African heritage of large circles of family

and friends, who simply must be invited to the event, does make weddings extremely expensive. We now recommend a small engagement and a larger wedding or a large engagement and a small intimate wedding, as a practical way of reducing costs. We keep telling our clients, there is life after the wedding day!”

It is about the marriage and not the wedding.

Financial concerns are a leading source of tension in relationships and have some part in most divorces, yet most couples go into marriage without ever broaching money matters. It may not be romantic, but it

is important. Don’t let the wedding ruin your marriage!

Nimi Akinkugbe has extensive experience in private wealth management.

She seeks to empower people regarding their finances and offers frank,

practical insights to create a greater awareness and understanding of

personal finance.

For more personal finance tips, contact Nimi:

Email: info@moneymatterswithnimi

Website: www.moneymatterswithnimi.com

Twitter: @MMWITHNIMI

Instagram: @MMWITHNIMI

Facebook: MoneyMatterswithNimi